In the realm of business, ensuring seamless and efficient transactions is pivotal. A merchant account acts as a bridge, ensuring smooth monetary transactions between buyers and sellers. It allows businesses to accept payments via credit or debit cards, bolstering the overall customer experience by providing a plethora of payment options.

The Role of Merchant Accounts in Enhancing Customer Experience

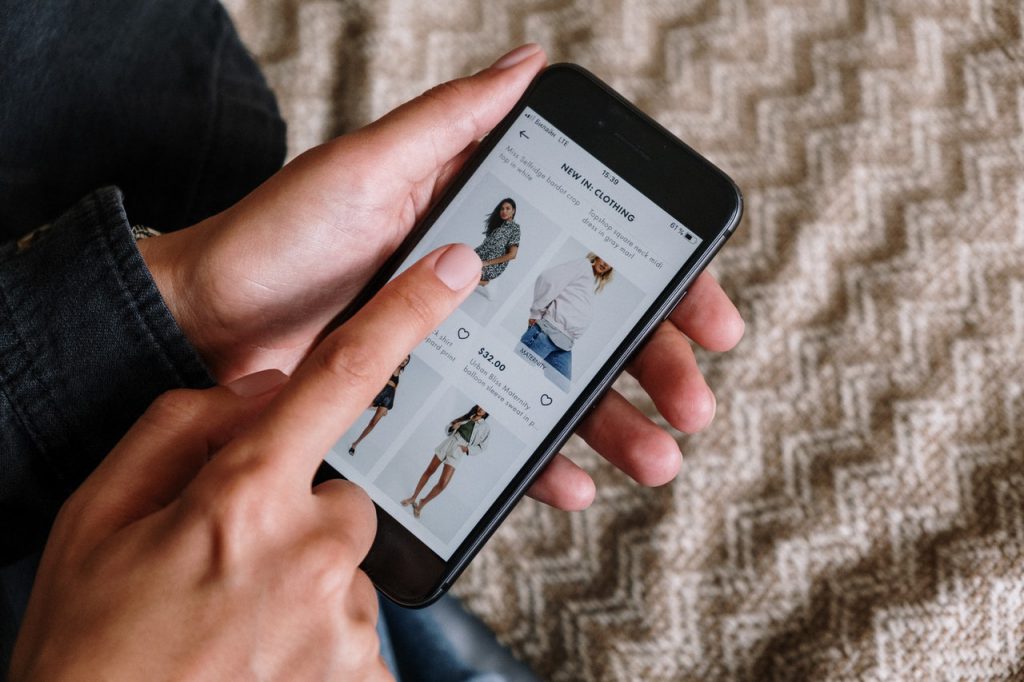

The customer experience is greatly enhanced when various payment options are available. Without a merchant account, businesses are limited to cash or cheque transactions, which can be inconvenient for many customers in today’s digital age. Having a merchant account allows businesses to accept both online and offline card payments, which is crucial for e-commerce businesses or any business looking to expand their online presence. When you start an online business, you quickly realize the need for reliable payment processing. Without a merchant account, you may find it challenging to accept card payments, thereby limiting your customer reach and potential revenue. For businesses to truly capitalize on the global marketplace, having a merchant account is not just beneficial but crucial.

We Tranxact LTD for Seamless Transactions

By choosing We Tranxact LTD for your Merchant Accounts in UK, you ensure that your business transactions remain smooth, secure, and reliable. This choice provides your customers with a seamless and reliable payment experience, establishing trust and satisfaction among your client base. With us, you can focus more on your business growth rather than worrying about payment processing issues.

How Merchant Accounts Aid in Business Growth

Apart from enhancing the customer experience, having a merchant account contributes to business growth. It broadens the horizons for a business, enabling it to accept international transactions. This global reach allows businesses to expand their customer base, leading to increased sales and revenue. Moreover, businesses can avoid the hassles and risks associated with handling large amounts of cash, contributing to enhanced security and efficiency.

Benefits of Having a Merchant Account

- Wider Customer Reach: By accepting card payments, businesses can cater to a wider audience, including international customers.

- Increased Sales: Studies have shown that consumers tend to spend more when using credit cards compared to cash. This means potentially higher sales figures for businesses.

- Enhanced Credibility: Having a merchant account and offering card payment options can make a business appear more legitimate and trustworthy in the eyes of customers.

- Better Cash Flow Management: Electronic transactions are processed faster than cheques. This means quicker access to funds, helping businesses maintain a steady cash flow.

The Need for a Merchant Account in the UK

In the UK, where e-commerce and online businesses are proliferating, having a merchant account is not just an option but a necessity. Merchant Accounts UK is essential for handling online transactions securely and efficiently, ensuring customer satisfaction and loyalty. It is a critical component for any business looking to thrive in the online marketplace, providing both the business and its customers with convenience and security.

Conclusion:

In conclusion, opting for a merchant account is a strategic move for any business. It is essential for enhancing the customer experience, ensuring secure and efficient transactions, and contributing to business growth and expansion. Choose We Tranxact LTD for your Merchant Accounts needs to ensure the reliability and security of your business transactions, allowing you to focus on the other crucial aspects of growing your business.